Profit Maximization

-

Goal: Maximize the profit.

-

Allocation Algorithm: Give the object to the player with the

highest bid. -

Payment Scheme: The winner pays an amount equal to the

second highest bid.

Bayesian Setting

-

Sometimes it makes sense to assume that some partial information is known. (部分数据已知)

-

Assume that the valuations come from a known probability distribution. The distribution is common knowledge! (估值来自一个概率分布, 这个分布是一个 knowledge)

-

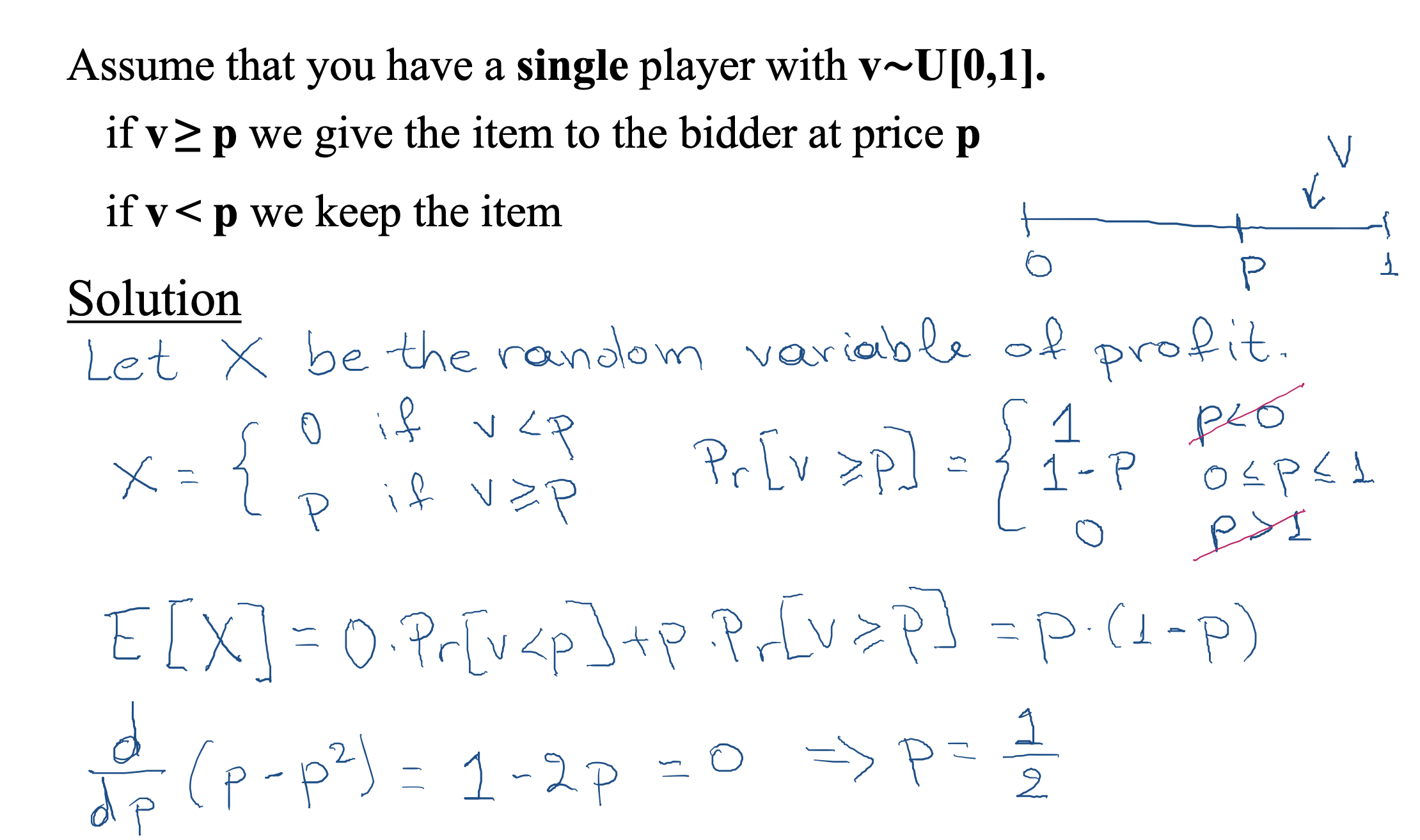

Assume that you have a single player with v1∼U[0,1].

-

What sort of mechanism would we devise to maximize the expected revenue?

- We post a price p

- if v≥ p we give the item to the bidder at price p

- if v < p we keep the item

-

What is the optimal price p?

The optimal price is p=1/2 and gives us expected revenue 1/4.

Second Price Auction

-

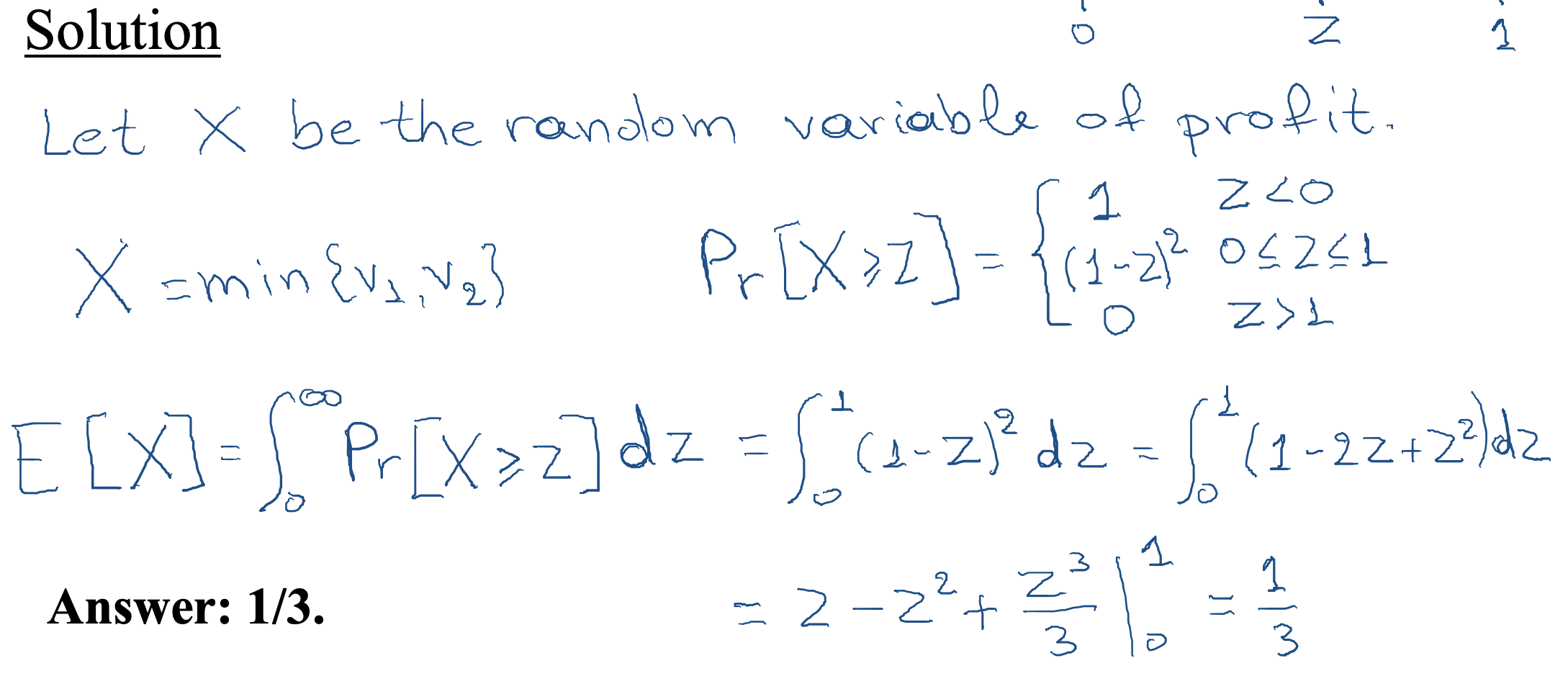

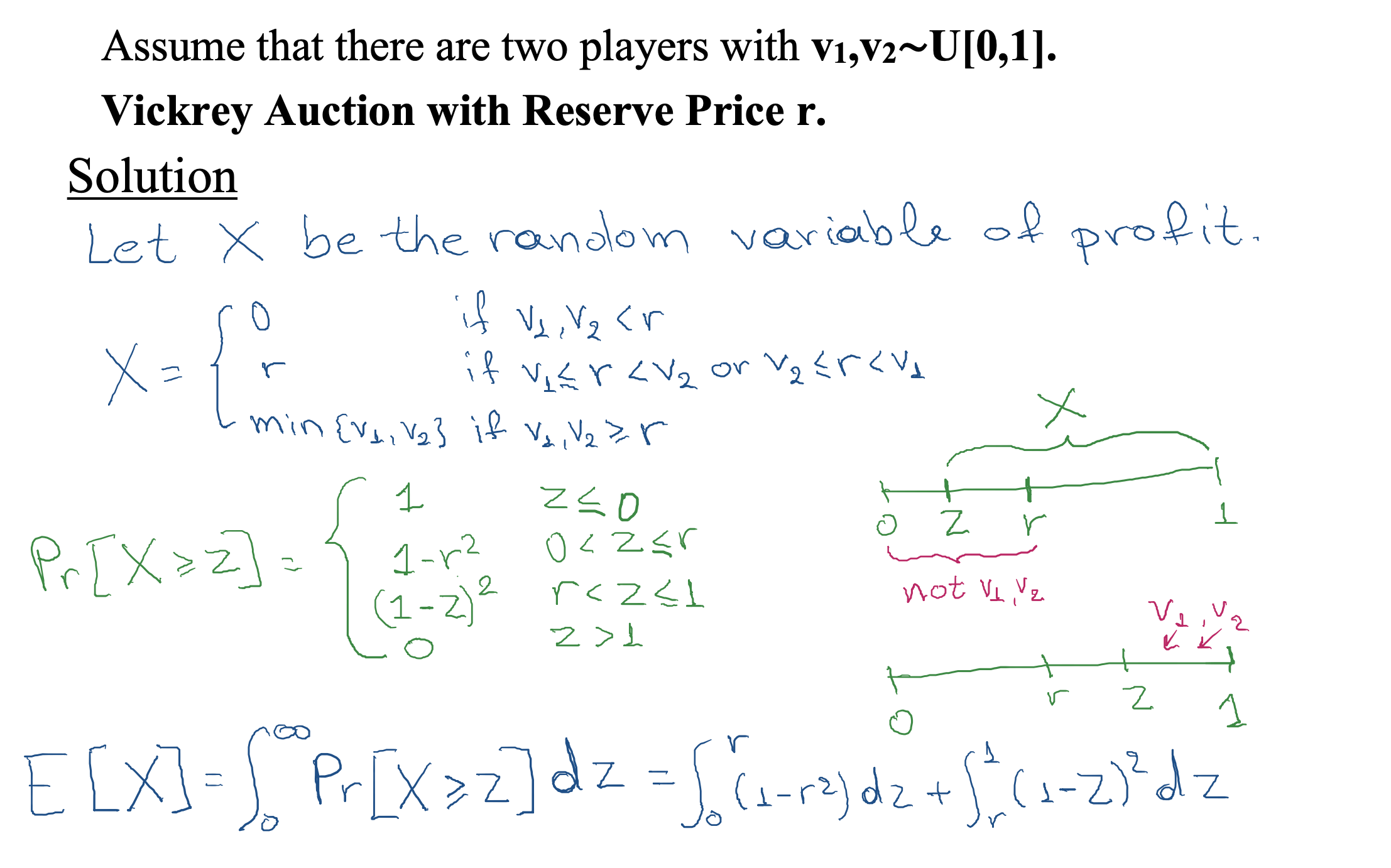

Assume that there are two players with v1,v2∼U[0,1].

-

What is the expected revenue that we get from the second price auction?

` - Truthful auction: we consider b1(v1)=v1, b2(v2)=v2.

- Answer: 1/3.

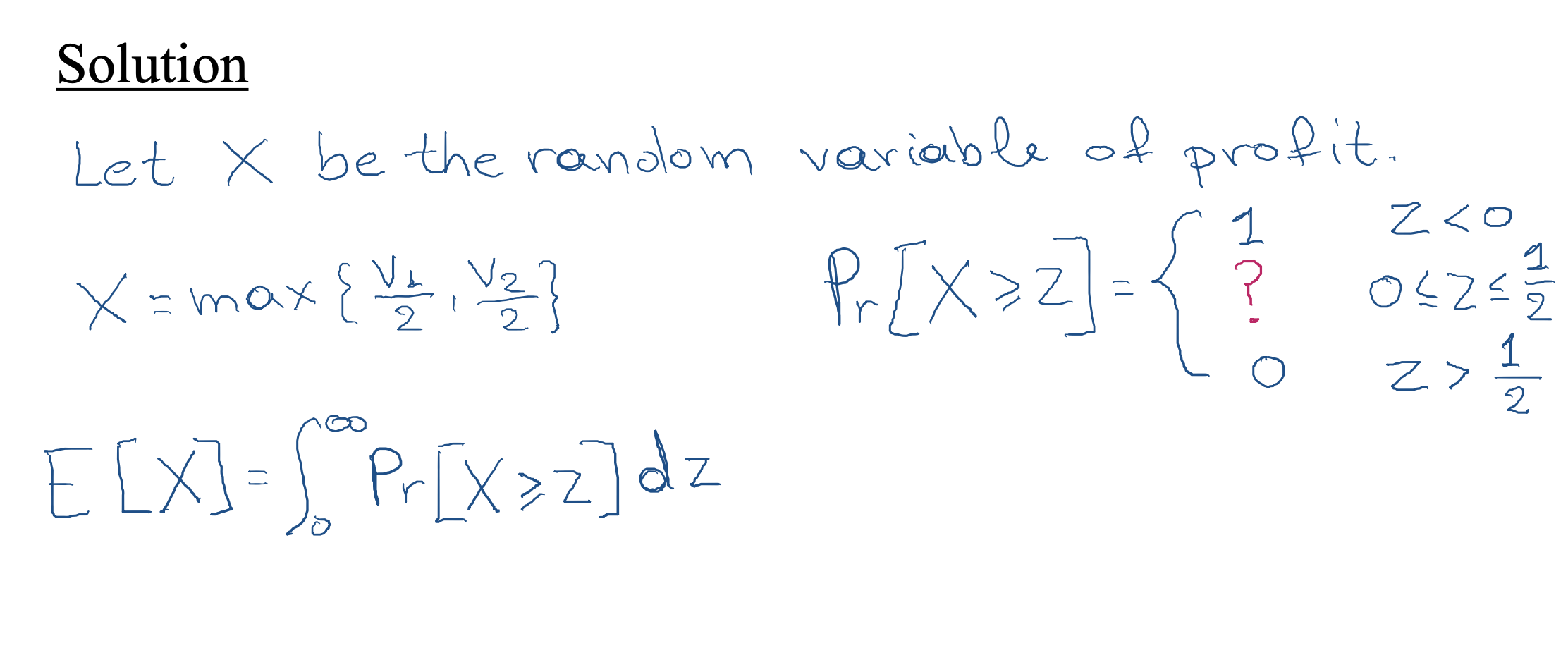

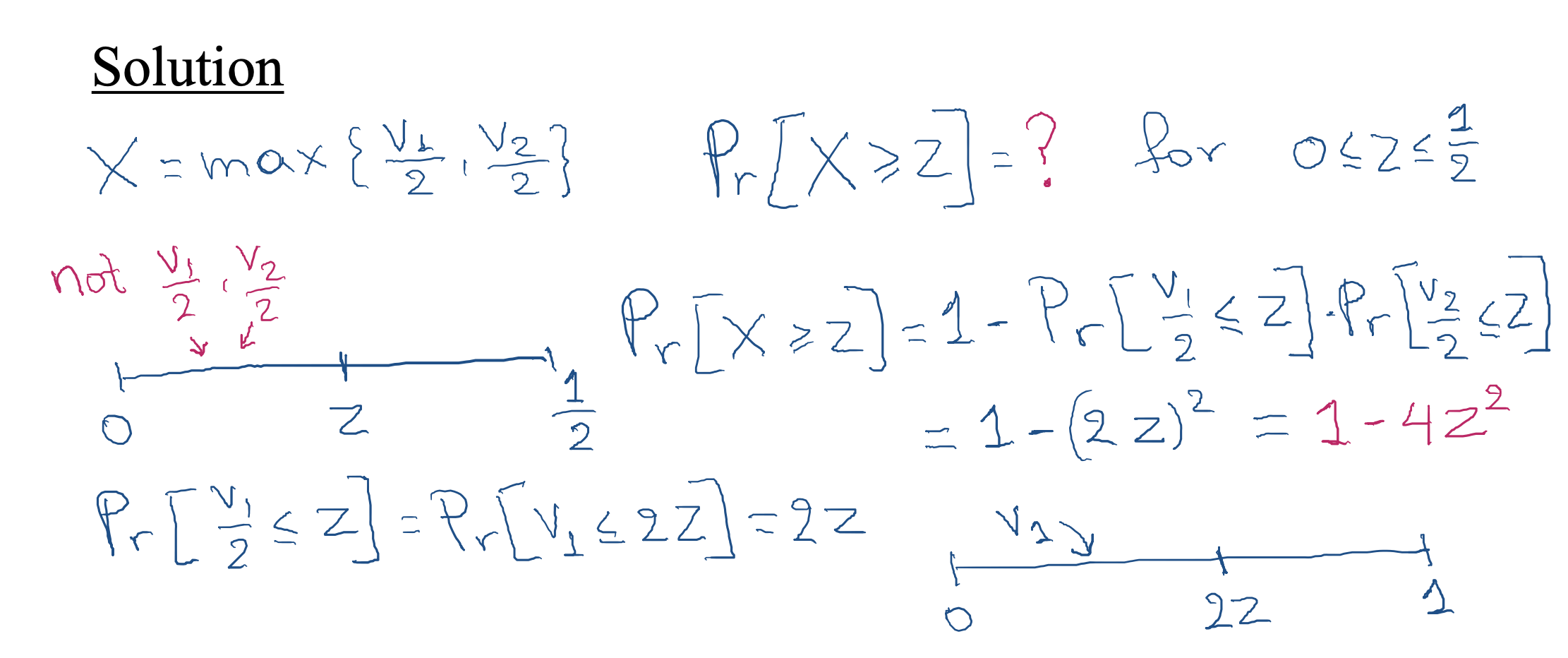

First Price Auction

-

Assume that there are two players with v1,v2∼U[0,1].

-

First price auction is not truthful.

-

What is a Bayesian Nash equilibrium for the first price auction?

- Answer: b1(v1) =

v1/2, b2(v2) =v2/2. (CANVAS)

- Answer: b1(v1) =

-

Notice that the social welfare is maximized in equilibrium, i.e. we assign the item to the highest true value!

Revenue Equivalence Principle

All single-item auctions that allocate (

in equilibrium) the item to the player withhighest valueand in whichlosers pay 0, will haveidentical expected revenue.

-

Assume that there are two players with v1,v2∼U[0,1].

-

Can we improve upon the 1/3 expected revenue in a truthful way?

-

Vickrey Auction with Reserve Price 1/2.

-

if v1 < 1/2 and v2 < 1/2 we do not allocate the item

-

if v1 < 1/2 and v2 ≥ 1/2 we allocate the item to bidder 2 for price of 1/2

-

if v1 ≥ 1/2 and v2 < 1/2 we allocate the item to bidder 1 for price of 1/2

-

if v1 ≥ 1/2 and v2 ≥ 1/2 we allocate the item to the highest bidder and charge him the second highest bid.

-

-

Is this auction truthful? Yes

-

Add a dummy bidder (auctioneer) with value 1⁄2. Run Vickrey auction.

-

This auction is an affine maximizer.

-

-

What is the expected revenue that we get from this auction?

- Answer: 5/12 > 4/12 = 1/3.

-

What is the highest expected revenue that we get from this auction?

- Answer: 5/12 (r=1/2)

Single item auction

-

Definition

-

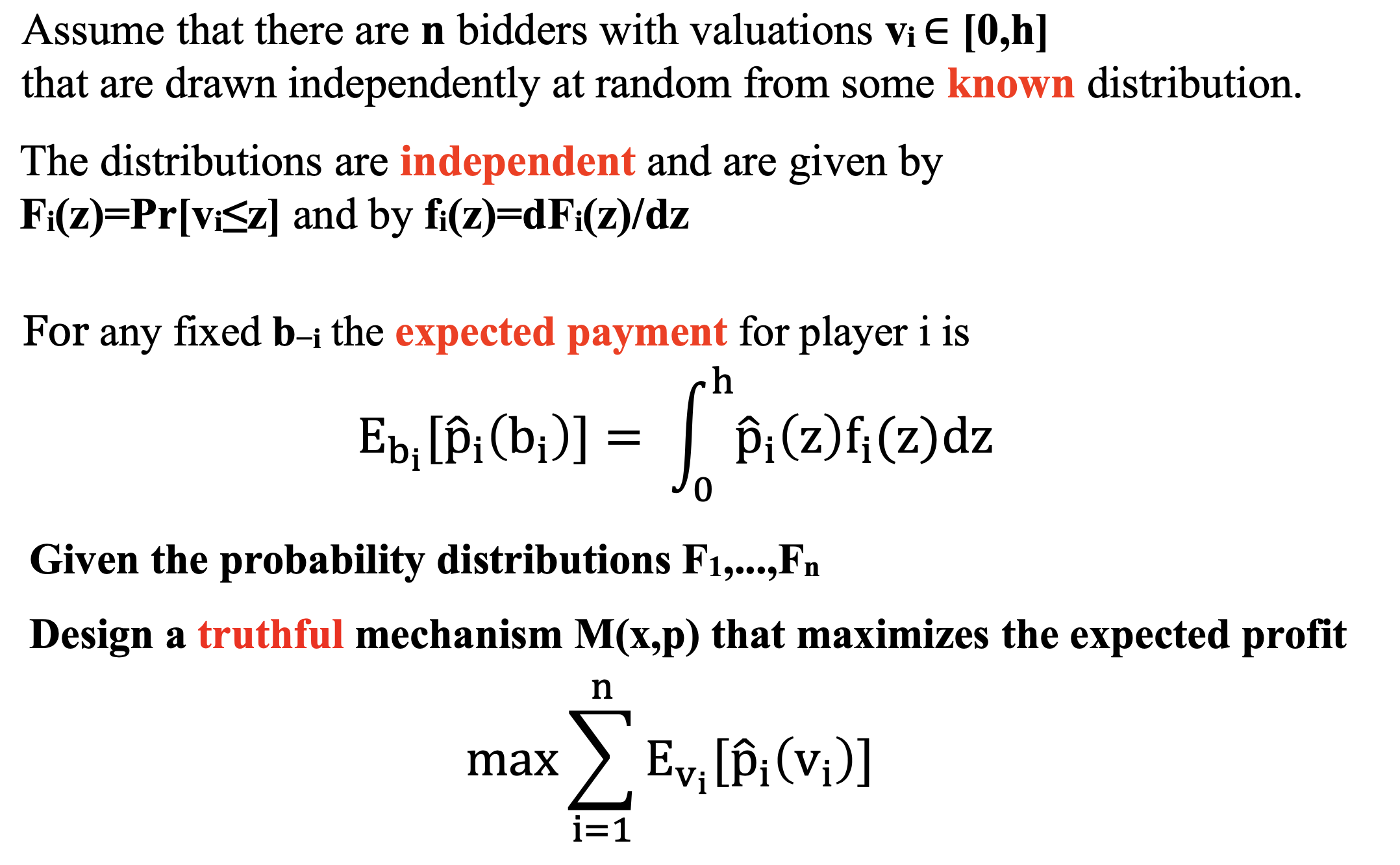

Assume that there are n bidders with vi ∈ [0,h].

-

Mechanism M(x, p1, … , pn)

-

Input: b=(b1,…,bn) the vector of declarations

-

Output: x(b) allocation function

-

xi(b)=1 if i gets the item

-

xi(b)=0 if i does not get the item

-

-

Output: p1(b),…,pn(b): payment functions

-

The utility of player i if his true value is vi but he reports bi is

ui(bi,b-i;vi)= vi⋅xi(bi,b-i)-pi(bi,b-i)

-

-

Notice that player i’s valuation is a single-parameter.

-

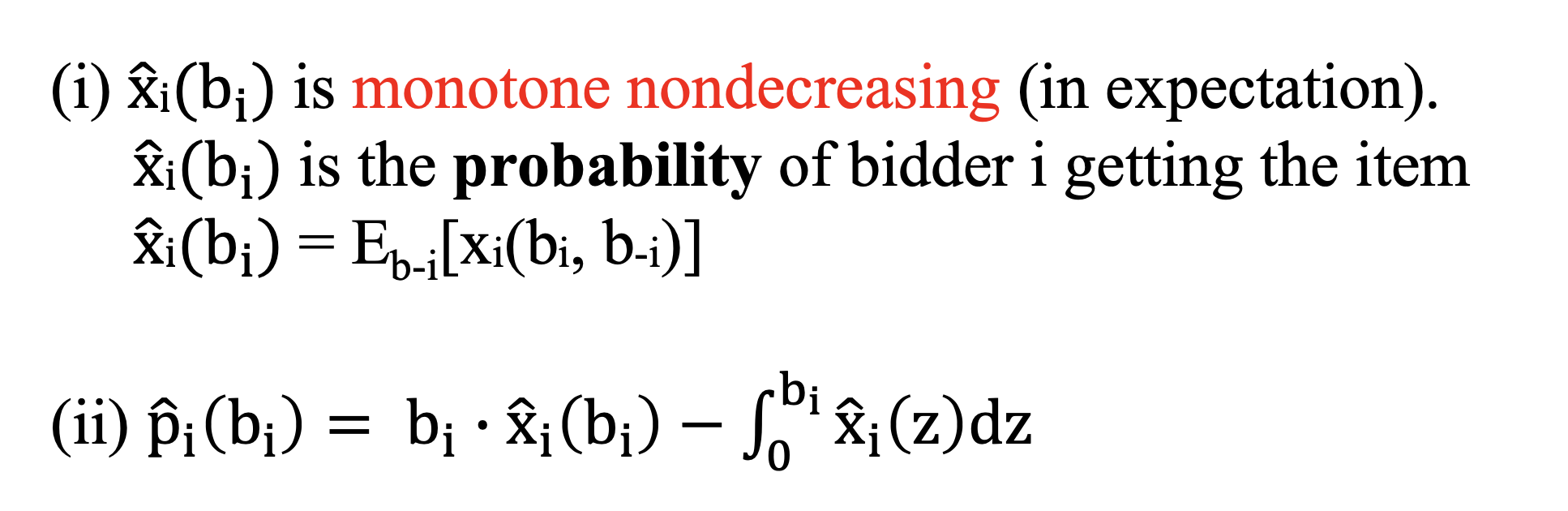

A mechanism is truthful if for every i, bi,vi,b-i

ui(vi,b-i;vi) ≥ ui(bi,b-i;vi)

vi⋅xi(vi,b-i)-pi(vi,b-i) ≥ vi⋅xi(bi,b-i)-pi(bi,b-i)

-

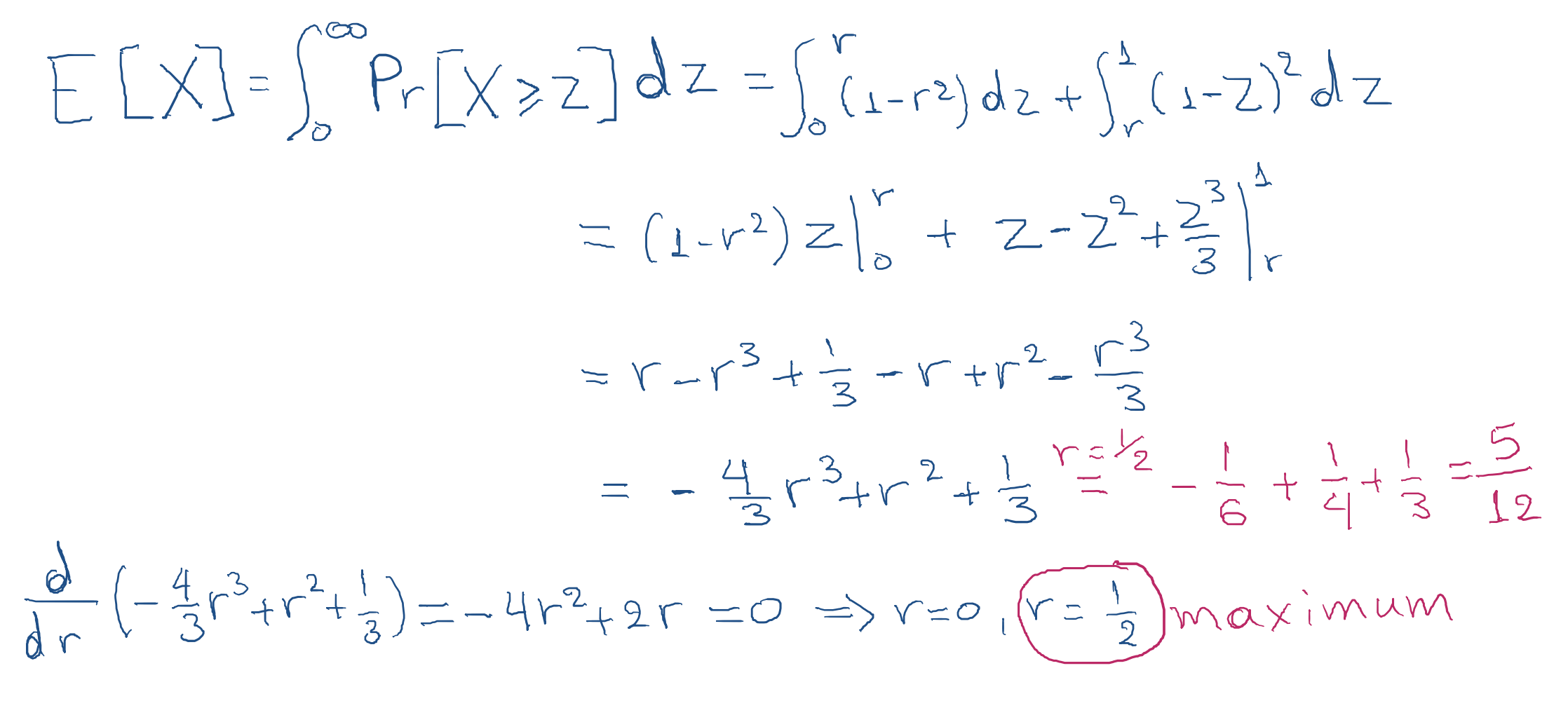

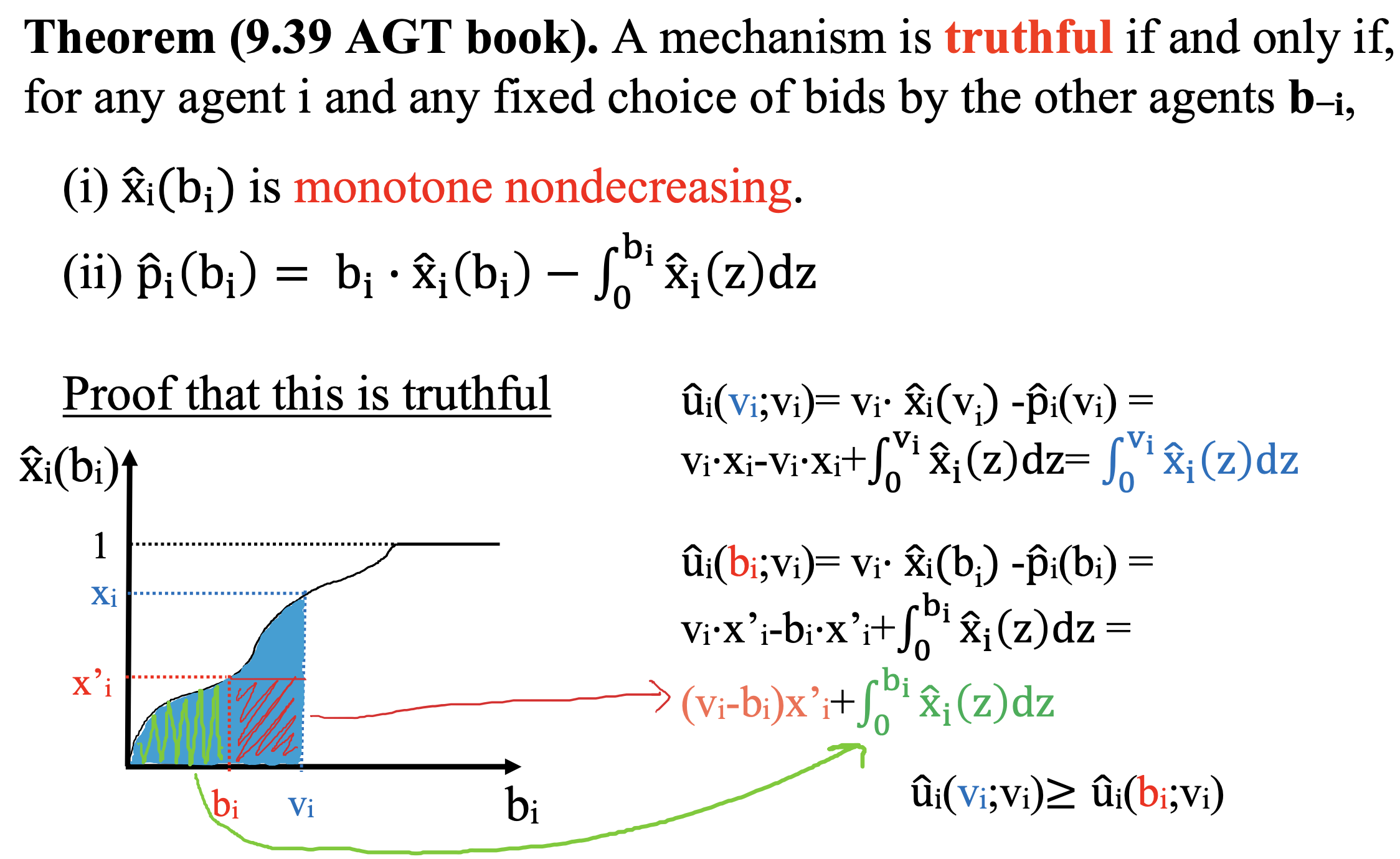

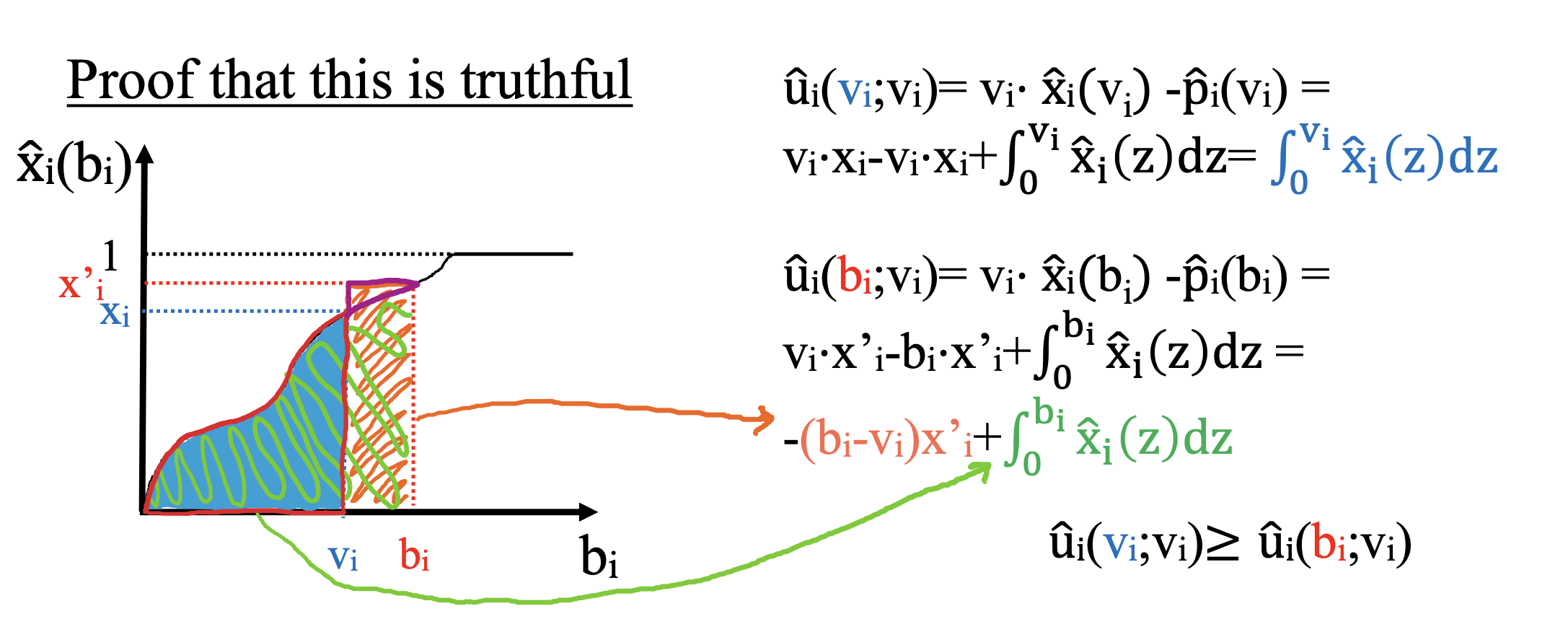

Theorem (9.39 AGT book). A mechanism is truthful if and only if, for any agent i and any fixed choice of bids by the other agents b−i,

-

Example:

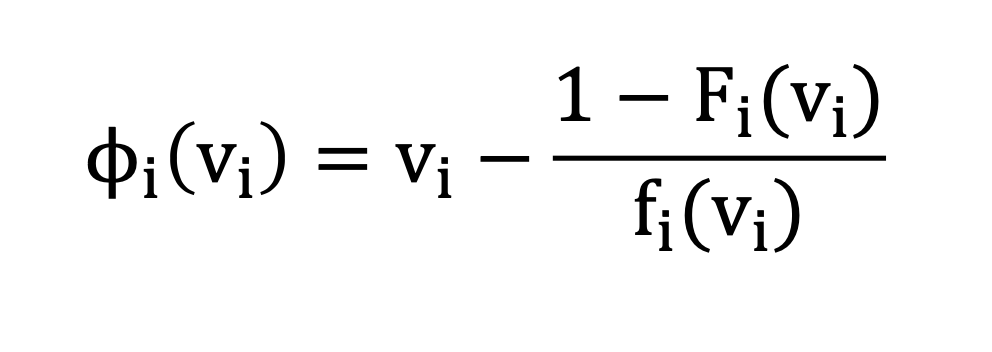

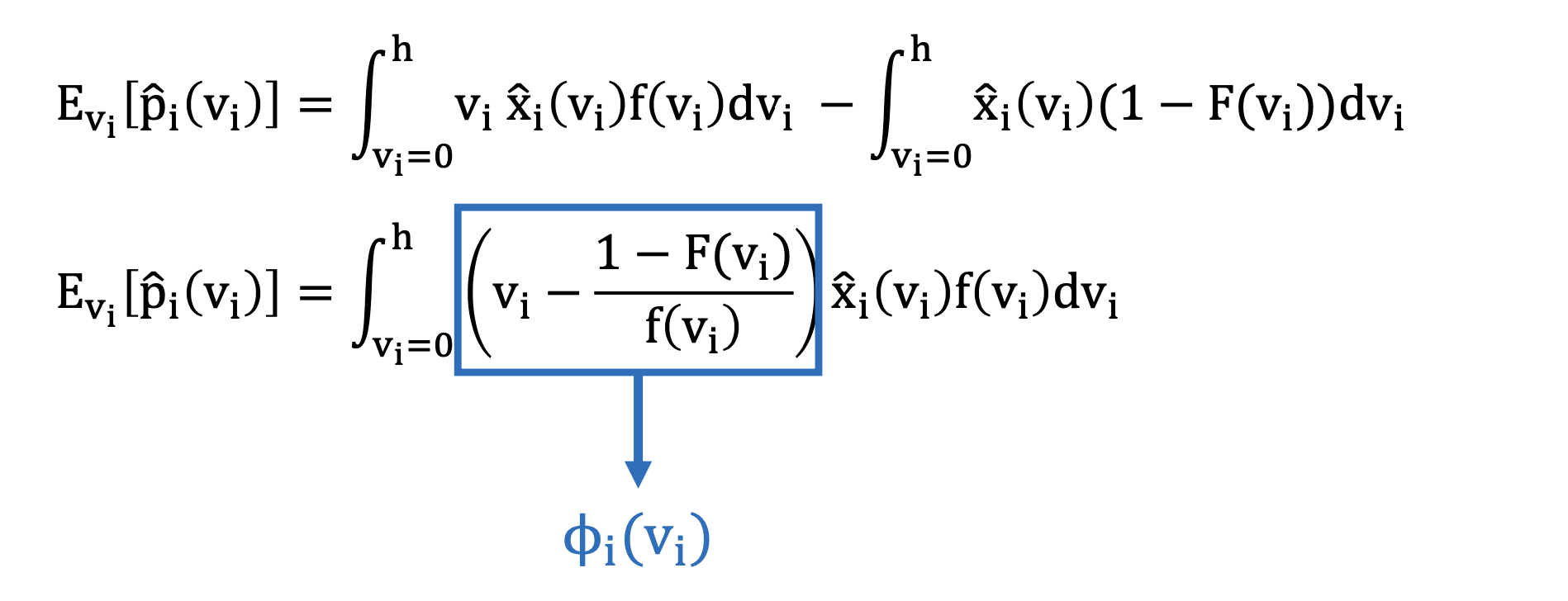

Virtual valuations

-

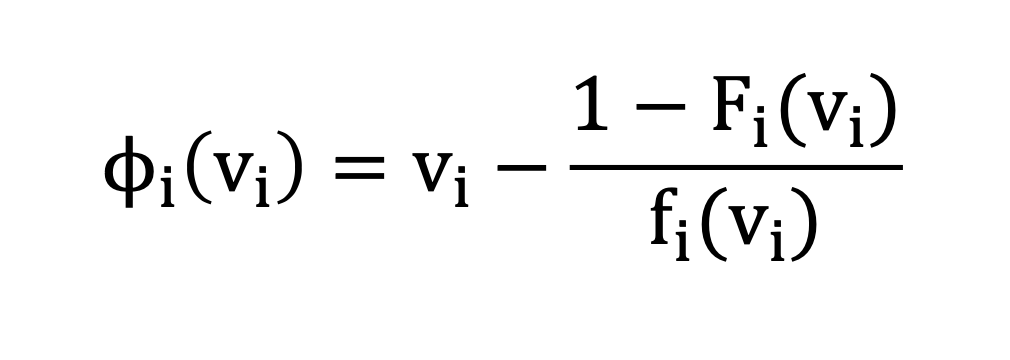

Definition. The virtual valuation of agent i with valuation vi is

-

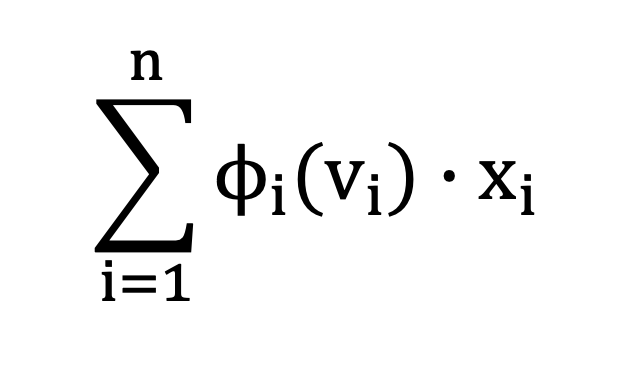

Definition. Given valuations, vi , and corresponding virtual valuations, φi(vi), the virtual surplus (social welfare) of allocation x is

-

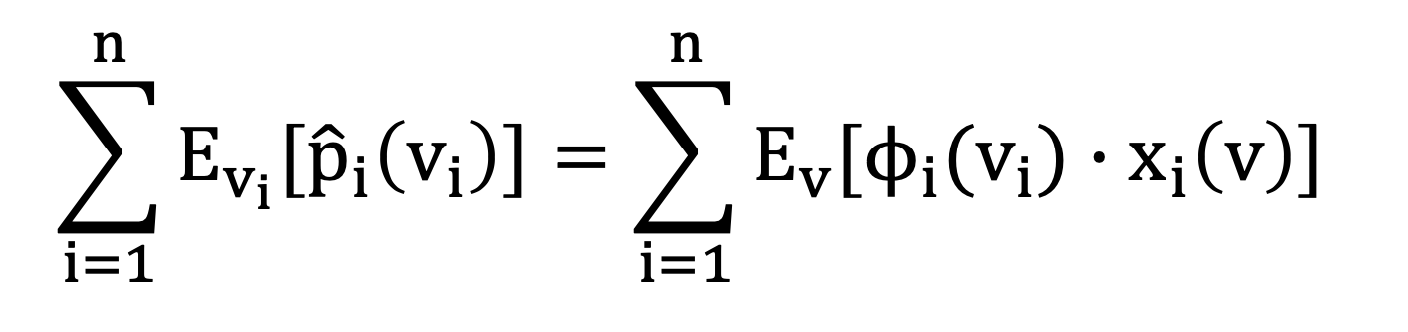

Theorem. The expected profit of any truthful mechanism, M, is equal to its expected virtual surplus

- example

-

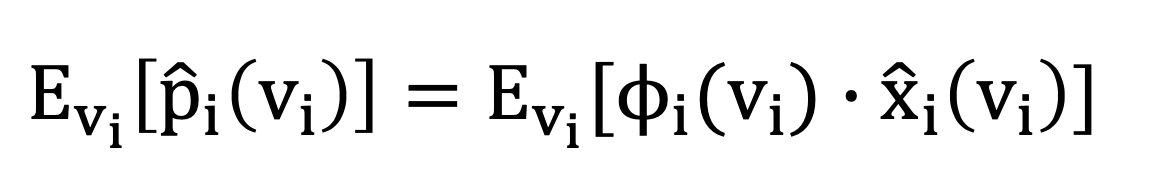

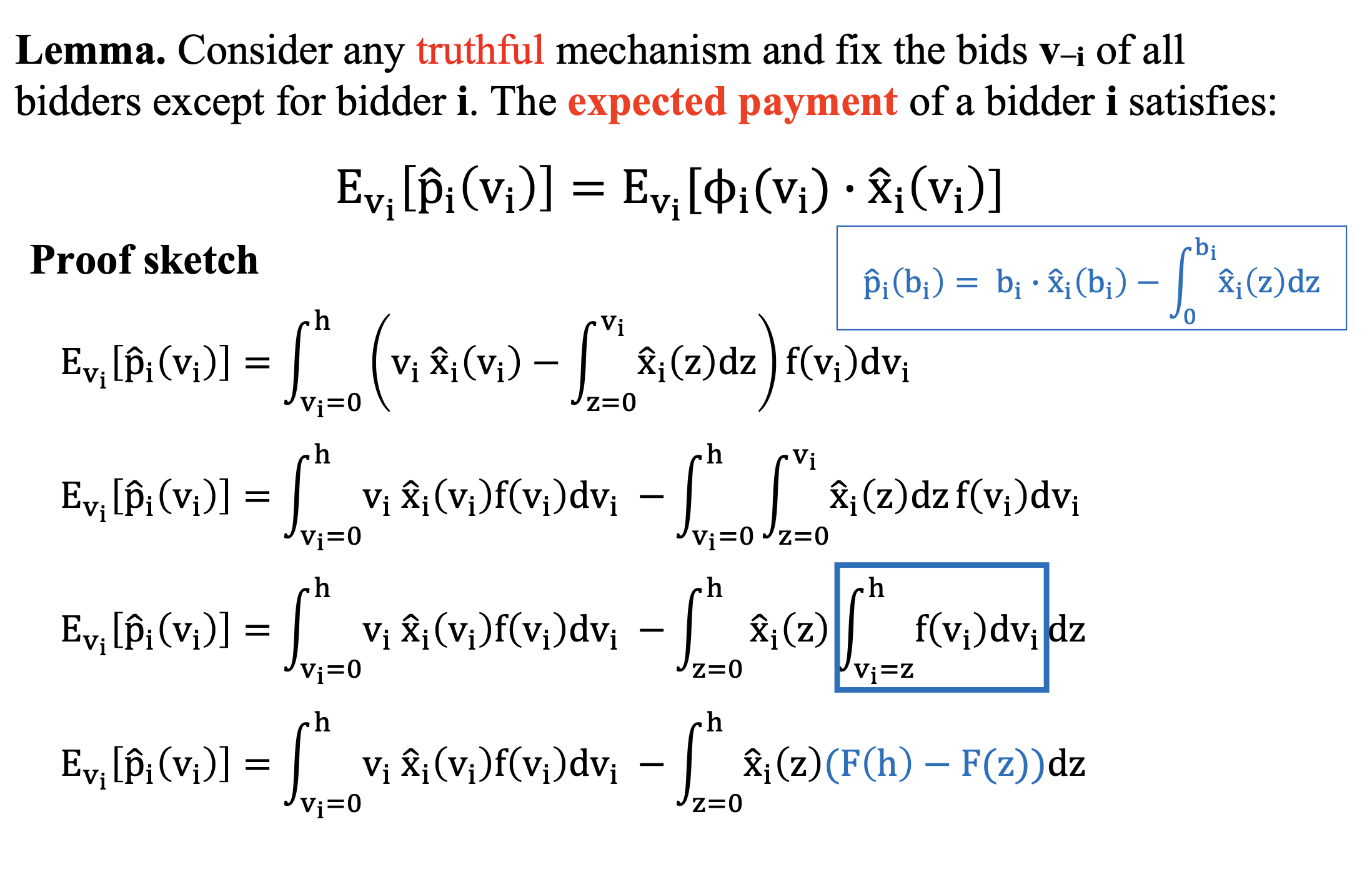

Lemma. Consider any truthful mechanism and fix the bids v−i of all bidders except for bidder i. The expected payment of a bidder i satisfies:

-

proof:

-

-

Lemma. Virtual surplus maximization is truthful if and only if, for all i, φi(vi) is monotone nondecreasing in vi.

Myerson’s Optimal Mechanism

-

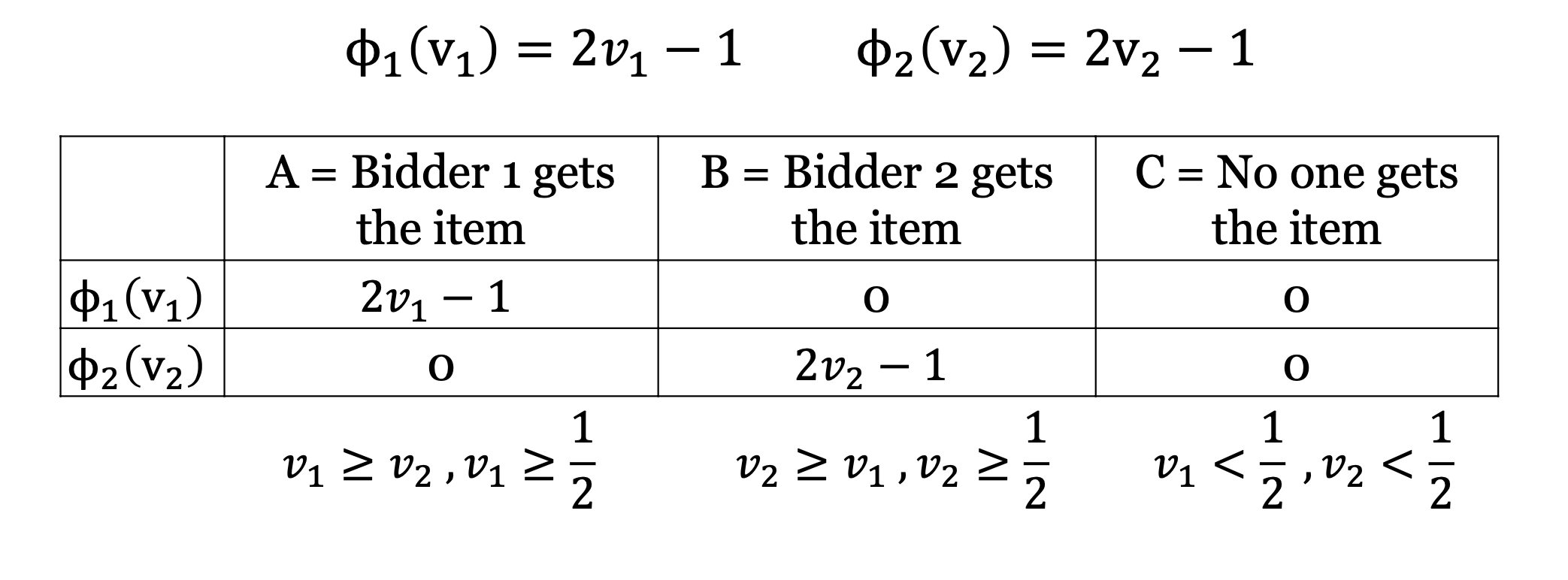

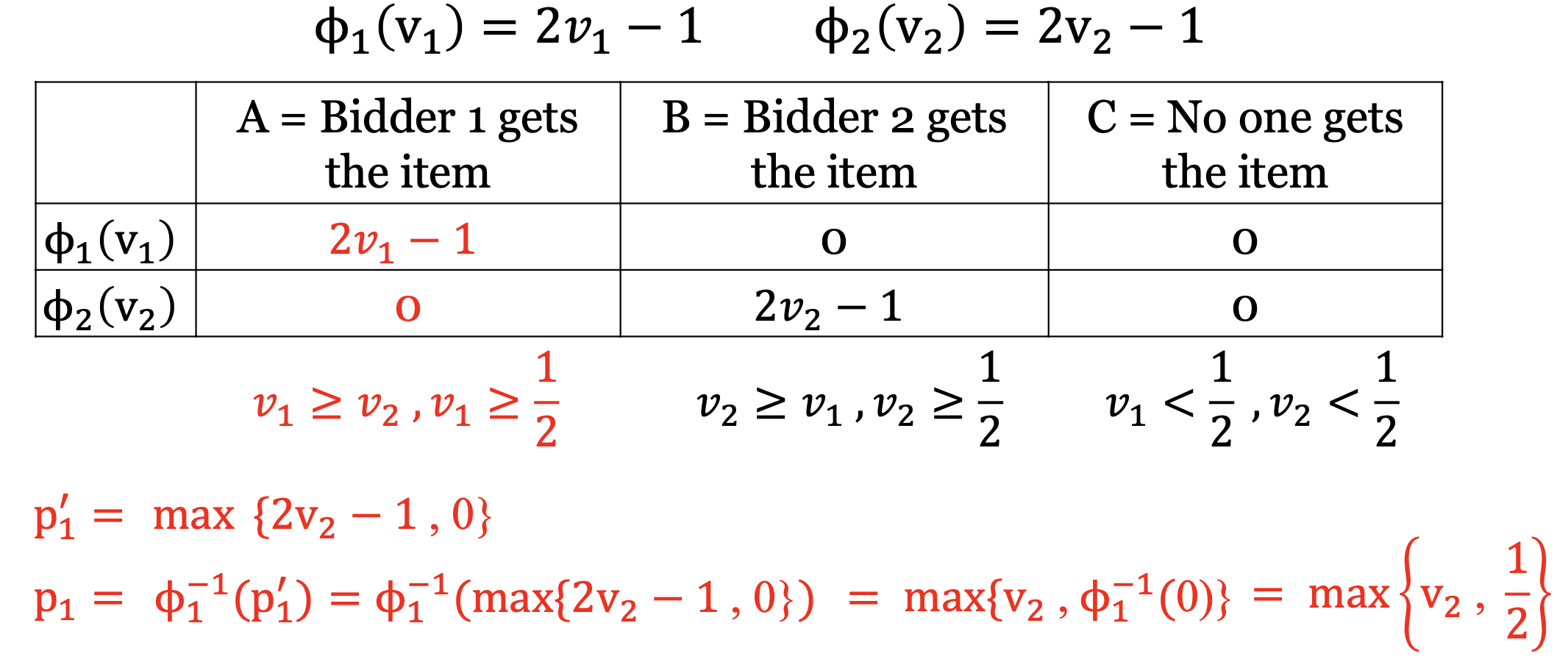

Definition: MyeF(b)

-

Given the bids b and F, compute “virtual bids”: b′i = φi(bi).

-

Run VCG on the virtual bids b′ to get x′ and p′

-

Output x = x′ and p with pi = φ−1i (p′i) (upon winning).

-

-

MyeF(v1,v2): Vickrey Auction with Reserve Price 1/2

-

Q: Can we do better?

- No, Mayerson’s mechanism is optimal.